Batch payments overview

What is a batch payment?

A batch payment refers to a group of insurance or patient payments deposited by a clinic or practice.

In the system, it is a tool for grouping multiple payments into a single batch so you can then allocate the payments to patient or insurance charges.

Batch payments are also an important part of processing insurance claims.

Why would I use a batch payment?

A batch payment allows you to group payments from multiple sources to make the process of entering multiple payments more efficient than entering, allocating, and processing single payments at a time. It is particularly helpful for bookkeeping when multiple payments were deposited to your bank account at the same time.

After you enter the details of each insurance payment included in the batch, you can allocate parts of each individual payment to multiple patients and claims based on the explanation of benefits (EOB). This process also updates the claim's status and can generate additional claims for secondary insurance.

Where do I add payments to a batch?

A batch payment and the insurance or patient payments it contains are entered from Practice > Payments > Batch Payments.

Entering and allocating a payment in a batch is done at the practice level, so you don't have to search and open every single patient record to find every procedure and enter a payment against each.

You can record patient payments without a batch from Patient > Financials but insurance payments can only be entered as part of a batch.

If your practice uses the Electronic Remittance Advice (ERA) integration, you can add ERA payments into a batch from Practice > Insurance > ERAs.

What happens after I add payments to a batch?

The batch payment workflow includes tools for allocating payments, as well as for processing insurance claims.

After you enter the details of the payments included in a batch, you can:

- Allocate all or part of an insurance payment to insurance charges on a claim.

- Attach an explanation of benefits (EOB) from the insurance carrier to the insurance payment.

- If insurance doesn't cover the full cost from a claim, you can:

- Transfer the remaining cost to the patient.

- Transfer the remaining cost to secondary insurance and submit a secondary claim.

- Adjust the remaining balance as a Contractual Adjustment with that carrier, or as a regular adjustment such as a write-off.

- Enter denial or rejection codes that explain why a claim was not paid.

- Re-submit claims that included errors.

- If insurance overpays for a claim, you can:

- Refund the overpayment to insurance.

- Turn the overpayment into a credit for insurance to use on a future explanation of benefits (EOB) from them.

- Transfer the overpayment to the patient as a credit.

- Refund the entire payment to insurance and submit a corrective claim with updated details.

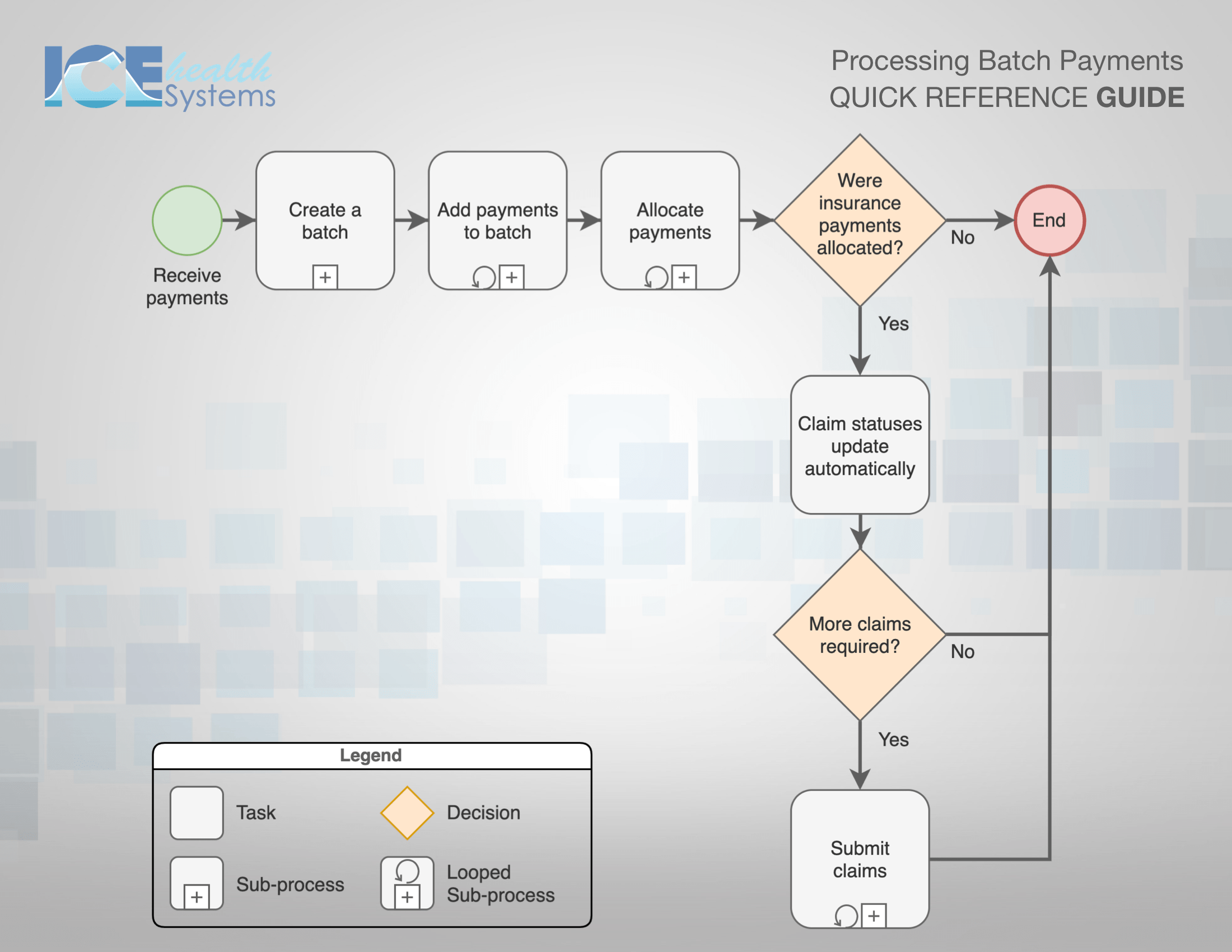

Here is a flowchart illustrating the overall workflow for entering batch payments and allocating payments.

- To learn more about a task, select it in this interactive PDF version to open a related help article: PDF - Processing Batch Payments.

How are words like Batch Payment and Lockbox used in ICE Health Systems?

You may use different words to describe this workflow, or maybe you use the same words in different ways.

Here are same important definitions to make sure we're using the same terminology.

- Batch Payment refers to a group of payments deposited by a practice.

- This deposit may contain cheques from insurance companies, cheques from individual patients, or a combination of both.

- A batch payment may be received through a bank's lockbox service if the practice uses one.

- Lockbox refers to a service where a practice pays for a bank to receive payments on behalf of the practice, often through a PO box.

- The bank regularly checks the lockbox to process and deposit any payments into the practice's account.

- Terms like "remittance services" or "remittance processing" may also be used to refer to lockbox services.

- Batch Summary refers to a document that describes all of the different payments that were deposited into your account as a batch.

- Insurance Payment refers to a cheque or electronic payment received from an insurance company that often covers multiple claims on different patients.

- Explanation of Benefits (EOB) refers to a document from an insurance company that explains how much of a claim they paid or why the claim was denied.

- The EOB is vital when allocating one large insurance payment to multiple claims on different patients.

- The insurance payment allocation workflow includes steps for what is sometimes referred to as EOB processing.

- An Electronic Remittance Advice (ERA) is an electronic version of an EOB that you can receive through an integration with a clearing house.